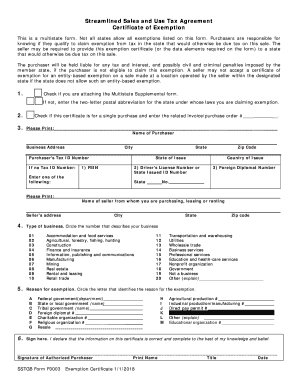

SSTGB F0003 2021-2026 free printable template

Show details

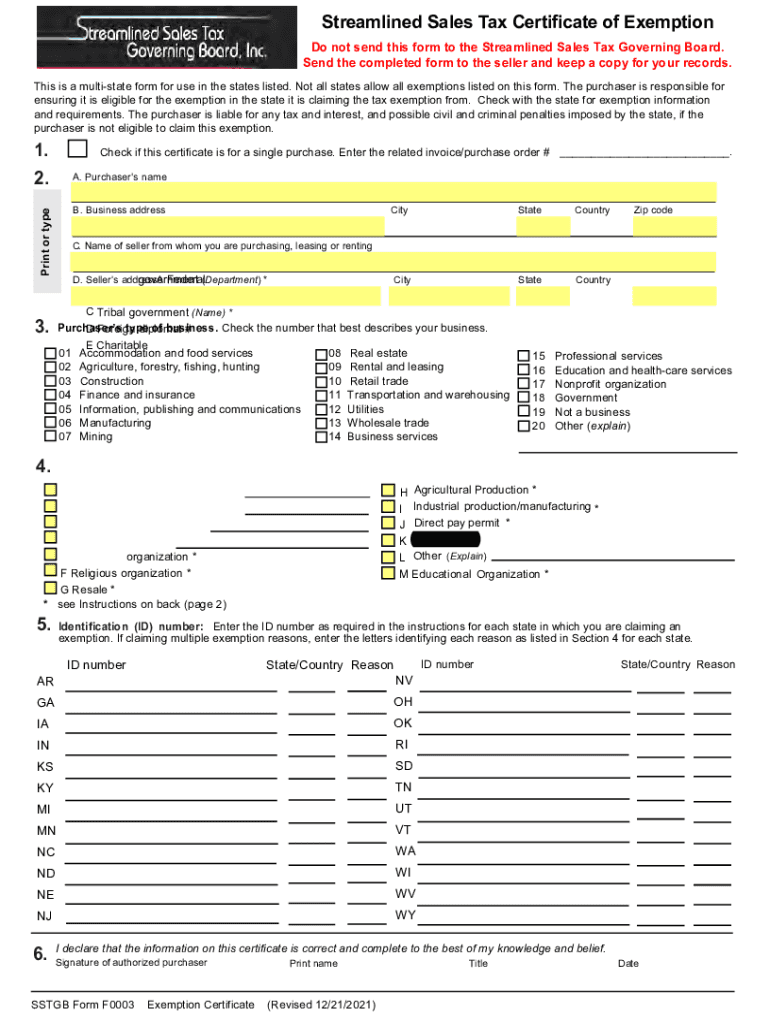

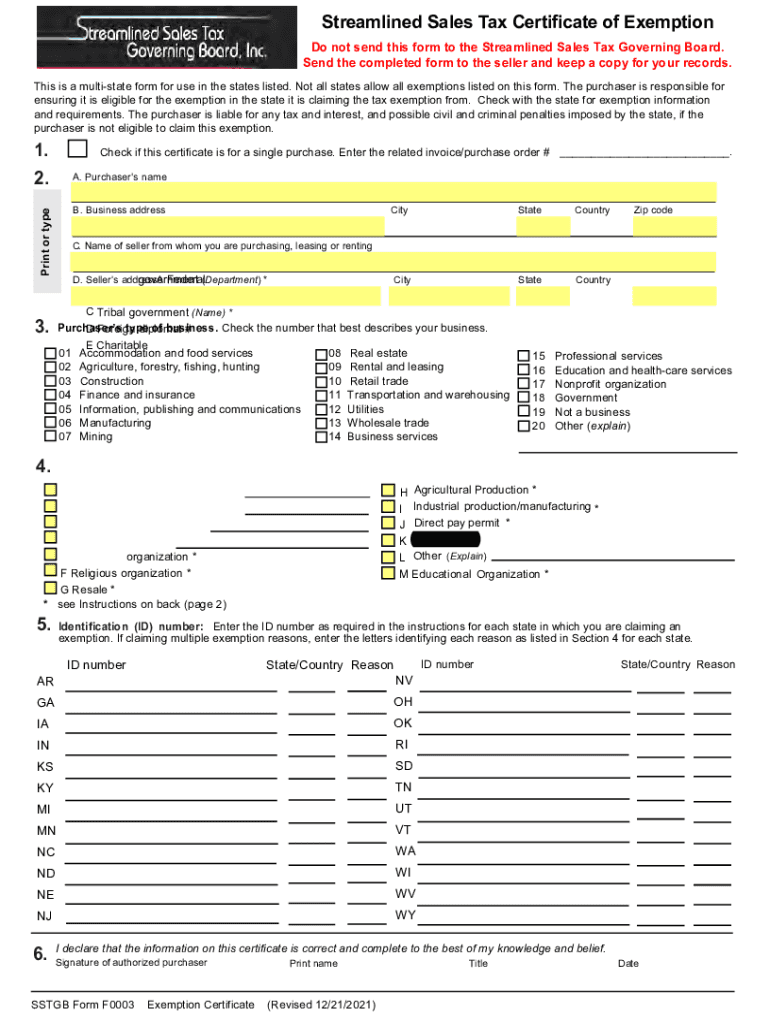

ID number AR State/Country Reason NV GA OH IA OK IN RI KS SD KY TN MI UT MN VT NC WA ND WI NE WV NJ WY I declare that the information on this certificate is correct and complete to the best of my knowledge and belief. Signature of authorized purchaser SSTGB Form F0003 Exemption Certificate Print name Revised 12/21/2021 Title Date Sections 1 6 are required information. A signature is not required if in electronic form. Section 1 Check the box for a single purchase and enter the invoice...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign sstgb form f0003 exemption certificate

Edit your streamlined sales tax exemption certificate form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your streamlined sales tax form fillable form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit streamlined sales tax exemption online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit state tax exemption forms. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

SSTGB F0003 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out form f0003 exemption certificate printable

How to fill out SSTGB F0003

01

Start by downloading the SSTGB F0003 form from the official website.

02

Read the instructions carefully before proceeding to fill out the form.

03

Enter your personal details in the designated fields, including your name, address, and contact information.

04

Fill in the specific information requested in each section, such as the type of application or request.

05

Provide any required documentation or additional information as indicated.

06

Review your entries for accuracy and completeness.

07

Sign and date the form as required.

08

Submit the completed form according to the provided submission guidelines.

Who needs SSTGB F0003?

01

Individuals applying for a specific service or permission related to SSTGB regulations.

02

Businesses seeking compliance or registration with SSTGB requirements.

03

Anyone involved in an activity that necessitates formal documentation with the SSTGB.

Fill

form streamlined sales tax

: Try Risk Free

People Also Ask about sales tax agreement certificate exemption

Should I claim exemption on tax form?

Who Should Be Filing Exempt on Taxes? As noted above, you can claim an exemption from federal withholdings if you expect a refund of all federal income tax withheld because you expect to have no tax liability and had no tax liability in the previous tax year.

Where can I get a tax exemption certificate in the US?

To apply for an initial or renewal tax exemption card, eligible missions and their members should submit an application on the Department's E-Government (E-Gov) system. Applications are generally processed within five business days.

What is the Arizona sales tax exemption form?

Arizona Forms 5000 are used to claim Arizona TPT (sales tax) exemptions from vendors. Arizona Forms 5000A are used to claim Arizona TPT (sales tax) exemptions from vendors when making purchases for resale where tax will be collected on the retail sale to the end user.

Is it better to claim 0 or 1 exemptions?

By placing a “0” on line 5, you are indicating that you want the most amount of tax taken out of your pay each pay period. If you wish to claim 1 for yourself instead, then less tax is taken out of your pay each pay period.

What is the exemption on a tax form?

What Does Filing Exempt on a W-4 Mean? When you file as exempt from withholding with your employer for federal tax withholding, you don't make any federal income tax payments during the year. (A taxpayer is still subject to FICA tax.)

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get streamlined sales tax certificate exemption?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the sales exemption in seconds. Open it immediately and begin modifying it with powerful editing options.

How do I fill out taxpayer exempt using my mobile device?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign streamlined certificate exemption and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

How do I edit new mexico tax exempt form pdf on an iOS device?

You certainly can. You can quickly edit, distribute, and sign form f0003 on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

What is SSTGB F0003?

SSTGB F0003 is a specific tax return form used for reporting goods and services tax (GST) in certain jurisdictions.

Who is required to file SSTGB F0003?

Businesses that are registered for goods and services tax and meet specific threshold criteria must file SSTGB F0003.

How to fill out SSTGB F0003?

To fill out SSTGB F0003, businesses must provide their registration details, report total sales, taxable supplies, and calculate GST owed or refundable.

What is the purpose of SSTGB F0003?

The purpose of SSTGB F0003 is to ensure compliance with GST regulations and to report the tax amounts owed or to be reclaimed from the authorities.

What information must be reported on SSTGB F0003?

Information that must be reported on SSTGB F0003 includes business identification details, total sales, exempt supplies, taxable supplies, and calculated GST amounts.

Fill out your SSTGB F0003 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

How To Streamlined Sales Tax Certificate Exemption is not the form you're looking for?Search for another form here.

Keywords relevant to streamlined sales and use tax agreement

Related to form streamlined exemption printable

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.